Rare Earth Elements: Imagine this in the 1950s, fishermen along Kerala’s beaches in Alappuzha noticed black sand glinting under the sun. Those sands weren’t ordinary; they were rich in monazite, a mineral full of rare earth elements (REEs) like cerium and lanthanum. Around the same time, India’s newly formed Atomic Energy Commission realized how valuable these minerals were for nuclear power and future technologies. That discovery led to the creation of Indian Rare Earths Limited (IREL) in 1950, which turned Kerala’s thorium-rich sands into a key part of India’s early atomic energy program much like how new mining projects in Odisha’s Ganjam district today are reviving old deposits for the clean energy era.

Now jump to 2025. China controls nearly 70% of global REE mining and 90% of refining, while India sits on the world’s third-largest reserves about 6.9 million metric tonnes, mostly along its coasts from Kerala to Gujarat. These 17 metals, essential for electric vehicles, wind turbines, and electronics, are suddenly in high demand. When IREL’s new Odisha plant started producing neodymium for Tata Motors’ EVs in 2024, it marked a big step toward cutting imports and avoiding global supply troubles.

From those early beach discoveries to today’s National Critical Mineral Mission (2025), India’s rare earth journey shows how forgotten sands are turning into billion-dollar assets powering gadgets, defence systems, and renewable energy, all while reducing dependence on foreign suppliers.

What are Rare Earths Elements (REEs)

Rare earth elements are a family of 17 metallic elements including the 15 lanthanides plus scandium and yttrium whose unique magnetic, luminescent, and catalytic properties underpin permanent magnets, batteries, sensors, and advanced electronics.

The most commercially critical for magnets are neodymium, praseodymium, dysprosium, terbium, and samarium, used in NdFeB and SmCo magnets essential for EV traction motors, wind turbine generators, and aerospace-defense applications. Because REE mining and especially separation/refining are complex, capital-intensive, and environmentally challenging, supply chains have concentrated geographically, creating strategic vulnerabilities for manufacturers and governments.

Why REEs matter now

Clean tech scale-up is supercharging REE demand: research cited by industry points to a 300–700% rise in usage by 2040 driven by EV and wind, with magnet materials the fastest-growing segment of the REE market. Persistent concentration risk is the driver – China accounts for roughly 70% of global mining and near 90% of refining today, a dominance that reverberates through autos, power equipment, and defense supply chains worldwide.

Forecasts suggest China’s mining share could fall to about 51% and refining to roughly 76% by 2030 as new capacity comes online elsewhere, but pricing power and technology depth will likely remain contested through this decade.

India’s Starting Position

India holds an estimated ~6% of world REE reserves concentrated in coastal monazite sands across Kerala, Tamil Nadu, Odisha, Andhra Pradesh, and Gujarat, yet contributes less than 1% of global production today, highlighting untapped geological potential. Estimates from government-linked reporting place India’s endowment at about 7.23 million tonnes of rare earth oxide contained in 13.15 million tonnes of monazite across coastal and inland deposits, underpinning a multi-decade resource base if processing and environmental management are scaled responsibly.

The Mines Ministry has auctioned multiple strategic mineral blocks five tranches totaling 55 offered and 34 awarded so far with a sixth tranche launched recently to accelerate exploration-to-extraction timelines.

Policy: From Ore to Magnets

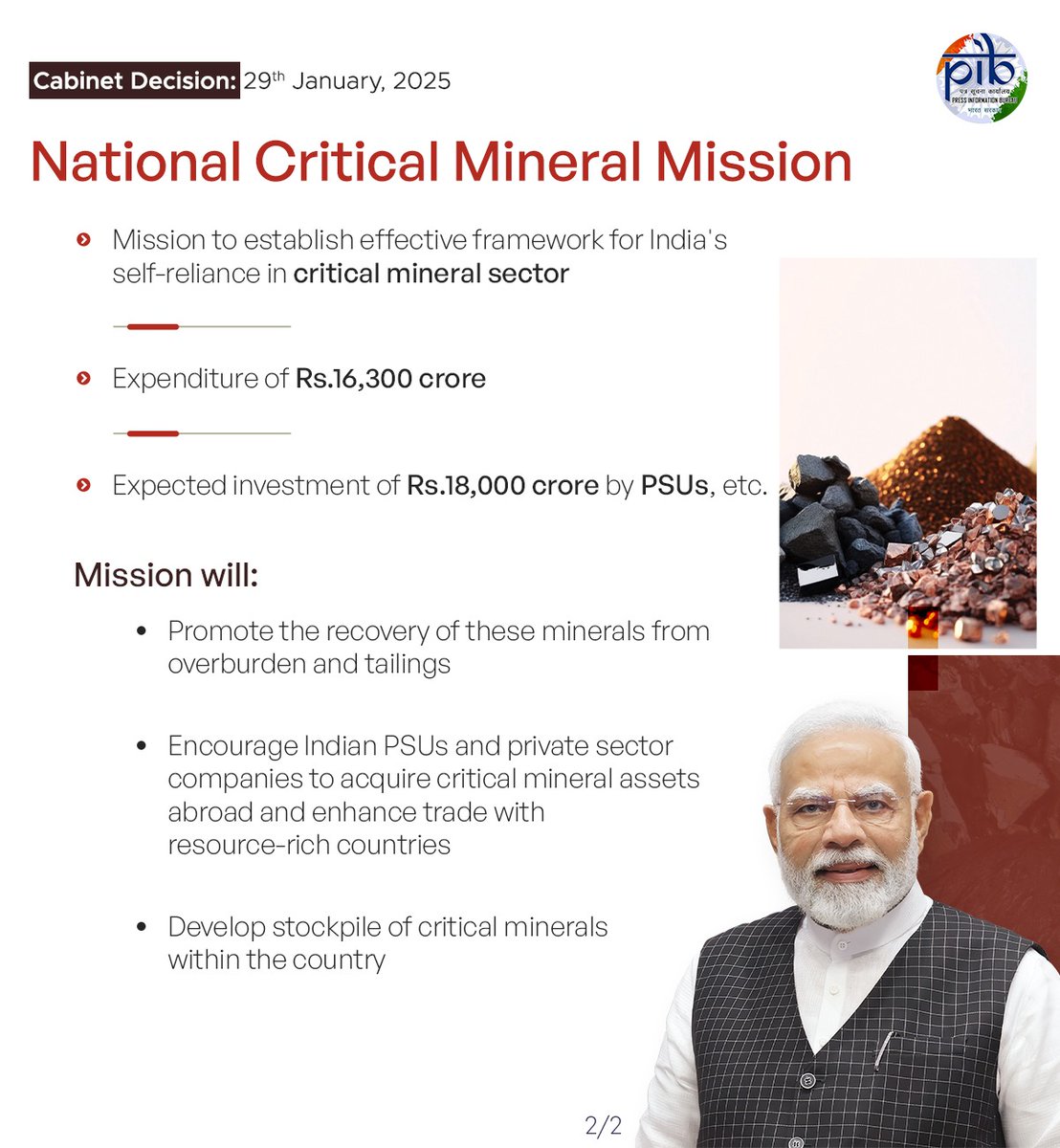

The National Critical Mineral Mission (NCMM) launched in 2025 provides the umbrella to coordinate exploration, refining, recycling, and end-use manufacturing across REEs and other critical minerals with a self-reliance goal for clean-tech supply chains.

Parallel efforts include a proposed National Critical Mineral Stockpile (NCMS) to build at least two months of REE inventories to cushion industry against export curbs and price spikes, with private participation envisioned for procurement and management.

Industrial Moves to Watch

IREL’s step-up is pivotal: the US removed IREL (India) Limited from its export control list in 2025, unlocking technology and collaboration channels previously constrained, especially for advanced processing and magnet manufacturing. IREL has commissioned a Rare Earth Permanent Magnet Plant in Visakhapatnam to produce samarium–cobalt magnets using indigenous technology, an early but strategic foothold in non-Chinese magnet capacity with defense and high-temperature applications.

Together with Production-Linked Incentive support and NCMM, this begins to stitch a domestic value chain from beach sands to separated oxides and finished magnets, reducing the historical trap of exporting raw minerals and importing high-value components.

Geopolitics and Supply Security

India has joined the US-led Mineral Security Partnership (MSP) and is mobilizing KABIL (Khanij Bidesh India Ltd.) to secure stakes in overseas critical mineral assets, diversifying import sources while domestic capacity scales up. China’s export management of rare earth magnets and materials has sharpened the urgency; India’s planned NCMS stockpile and magnet PLI are explicit hedges to keep factories running amid trade frictions and curbs.

With President Trump signaling the possibility of 100% tariffs on certain Chinese imports in response to export restrictions, predictable access to REEs becomes not just an industrial issue but a macro-competitiveness imperative for India’s manufacturing push.

Market Outlook and Numbers

Industry analysis indicates countries like Brazil (19% of reserves, minimal mining), India (6% reserves, ~0.7% mining), and Russia (9% reserves, ~0.7% mining) are under-extracting relative to their geological weight suggesting supply growth optionality as policy and capital align. India-focused commentary pegs REE demand growth at 300-700% by 2040, with the EV and wind sectors dominating new magnet demand, aligning with India’s Make in India goals for autos and renewables. Investor interest has risen alongside global headlines; rare earth equities globally have rallied on expectations of tighter trade policy and stockpiling, reinforcing the cyclical-volatility case for domestic buffers and diversified sources.

Industry use-cases in India

-

Automotive and EVs: NdFeB magnets enable compact, high-torque traction motors; domestic magnet capacity reduces import exposure for OEMs and tier-1s building in India’s expanding EV ecosystem.

-

Renewable power: Direct-drive wind turbines rely on high-grade magnets to improve efficiency and reduce gearbox complexity; localized magnet supply stabilizes project costs and timelines.

-

Electronics: Smartphones, data storage, and sensors depend on REE-based components; proximity to India’s growing electronics manufacturing boosts reliability and lowers currency and logistics risks.

-

Defense and aerospace: SmCo magnets and specialized REE alloys are used in guidance, radar, actuators, and jet engines; the Visakhapatnam SmCo line is strategically aligned with defense indigenization.

Constraints and Execution Risks

China’s leadership is rooted in decades of investment in high-yield separations, solvent extraction know-how, and environmental management trade-offs; catching up requires multi-year capex and skill-building across process engineering and waste handling.

Building a single separation plant is capital heavy, technology sensitive, and permitting-intensive, with environmental clearances and tailings stewardship as chokepoints that must be addressed with transparent standards to retain social license. India’s current processing capacity and specialized workforce are limited; without fast-tracking technology partnerships and training, mines-to-magnets integration risks delay, leaving OEMs to rely on imports longer than intended.

Strategic levers India is pulling

-

Stockpile and buffers: A two-month national REE stockpile under NCMS to smooth supply to priority sectors while domestic capacity scales, reducing the shock from export curbs and tariffs.

-

Magnet PLI: ₹7,300 crore over five years to seed 6,000 tonnes of domestic magnet output, anchoring demand for refined oxides and powders and incentivizing global JV entrants.

-

IREL enablement: Removal from US export controls plus commissioning of the REPM Visakhapatnam plant create a bridgehead for high-spec magnets and process learning-by-doing.

-

Overseas assets: KABIL’s mandate and MSP membership open pathways to equity offtake deals and technology partnerships, diversifying inputs beyond domestic monazite.

Implications for industry

For OEMs and tiered suppliers, localized REE value chains translate to better cost predictability, reduced lead times, and resilience against geopolitical shocks, especially in EV motors and wind systems where magnets are non-trivial bill-of-material items. For materials companies, separation plants, metal/alloy facilities, and magnet fabrication lines represent a stacked capex pipeline with attractive policy tailwinds, but require patient capital and specialist operators to achieve yields and environmental compliance. For financiers, the combination of NCMM, PLI, and stockpile programs creates clearer revenue visibility; however, diligence must account for technology partners’ track records in solvent extraction, powder metallurgy, and waste management.

What to watch in 2026-30

-

Speed of separation capacity: Awarding and commissioning of mixed REE separation plants to shift India from concentrate exporter to oxide producer will be the decisive metric of upstream progress.

-

Magnet line ramp: Utilization rates and product mix at the Visakhapatnam SmCo plant and any new NdFeB facilities under PLI will indicate how quickly India can service EV and wind pipelines domestically.

-

Stockpile build: Operationalization of NCMS, inventory governance, and integration with defense and energy OEMs will test institutional readiness for strategic reserves.

-

Global rebalancing: Watch how China’s share trends toward 2030 and how US/EU/Japan-Australia capacity additions impact price spreads, contract tenors, and JV flows into India.

India’s REE opportunity is not merely about mining more monazite; it is about owning the midstream separation, metals, alloys, and magnets where value, IP, and leverage lie for EVs, wind, electronics, and defense. The policy architecture – NCMM, NCMS, and magnet PLI combined with IREL’s new collaboration space and an initial SmCo magnet foothold, gives India a realistic path to become a second-source hub in a world seeking China-plus-one resilience. Execution – technology depth, environmental stewardship, and skill scale-up will determine whether India converts 6% of reserves into durable industrial competitiveness over the next five years.