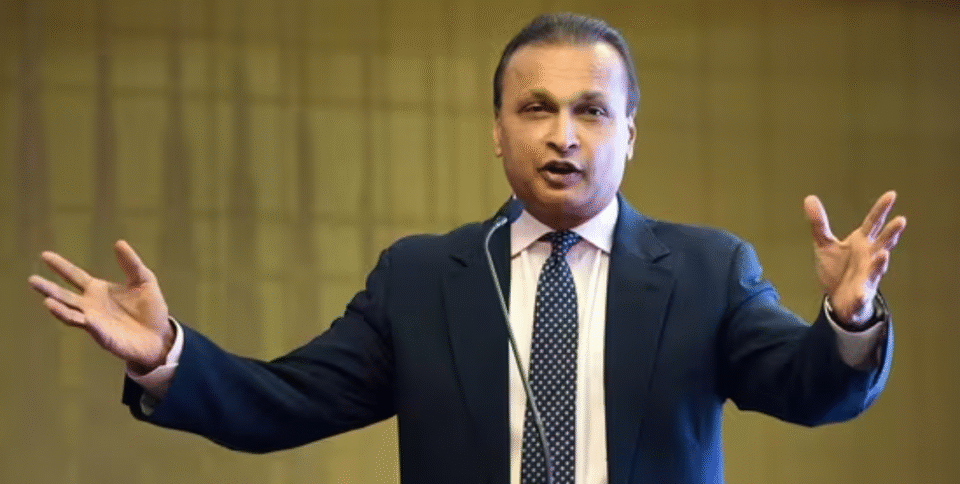

Mumbai, July 24 — The Enforcement Directorate (ED) on Thursday launched massive searches at over 35 locations across Mumbai in connection with a Rs 3,000 crore alleged bank loan fraud involving companies tied to Anil Ambani’s Reliance Group.

The raids are part of a money laundering investigation under the Prevention of Money Laundering Act (PMLA). ED sources said the case stems from loans given by Yes Bank to Anil Ambani group firms between 2017 and 2019, which were allegedly diverted to shell firms or misused through complex financial structures.

The ED is probing at least 50 companies and 25 individuals linked to the transactions, and flagged irregularities in the loan approval process, including back-dated credit approval memos, lack of due diligence, and dummy entities with common directors and addresses.

Sources said the ED has also identified a possible quid pro quo, where money flowed to entities associated with Yes Bank promoters just before loans were sanctioned.

The CBI, SEBI, National Housing Bank, Bank of Baroda, and NFRA have submitted reports pointing to a coordinated scheme to siphon off public funds, potentially misleading investors, banks, and shareholders.

In response, Reliance Power and Reliance Infrastructure stated that the ED action had no impact on their operations and distanced themselves from the matter. They clarified that the allegations pertain to Reliance Communications (RCOM) and Reliance Home Finance (RHFL) — firms no longer associated with Anil Ambani or their boards.

They also stressed that Anil Ambani currently holds no board position in the affected companies.