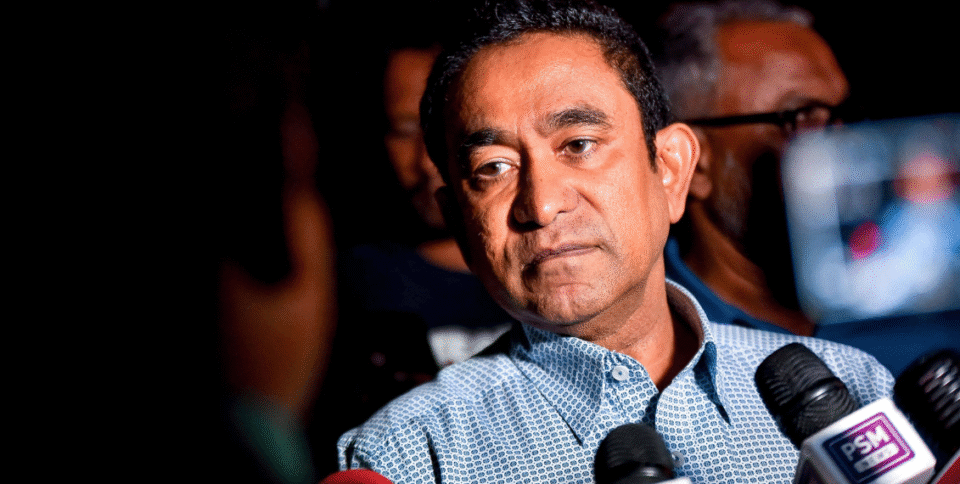

Male, August 8: Former Maldivian President Abdulla Yameen Abdul Gayoom says a recent move by the Maldives Monetary Authority (MMA) to withdraw MVR 2.1 billion ($136 million) from circulation will not affect the US dollar exchange rate, accusing the government of using the measure to secure funds ahead of local council elections.

The central bank announced Thursday that it had conducted its first reserve repurchase operation on July 23 as part of open market operations to reduce excess rufiyaa liquidity. According to the MMA, the step removed MVR 2.1 billion from the banking system.

Yameen, speaking at a Thursday night People’s National Front (PNF) gathering, said total excess liquidity in the market was closer to MVR 12 billion. “Stopping the circulation of just MVR 2.1 billion — 16 percent of the total — will have no impact on the US dollar rate,” he said.

The former leader argued that the dollar shortage remains unresolved. “The amount of rufiyaa outflowing for US dollars can be reduced, but availability is still a problem,” Yameen said, noting that resorts had exchanged only $300 million in the past six months under the Foreign Currency Act — far short of the level needed to stabilise the market.

Allegations of political funding

Yameen alleged the liquidity move was politically motivated, claiming the government, under President Mohamed Muizzu, might be tapping central bank-held funds to finance upcoming local elections. He suggested that state-owned companies lacked the capacity to generate the necessary cash, estimating the elections might require around MVR 400 million.

“There is currency in circulation, but no way of getting it. My analogy is that Muizzu needs MVR 400 million. With this, MVR 2 billion has entered MMA. Will the required funds be taken from that?” he asked.

Yameen accused MMA Governor Ahmed Munawwar of prioritising political considerations over economic policy, saying the move would not trouble him if it involved rufiyaa rather than US dollars — the latter being needed for foreign debt repayment.

Currency pressure and debt risk

The official US dollar exchange rate in the Maldives is MVR 15.42, but due to shortages, many resort to the black market where rates exceed MVR 20. Under current rules, banks must sell 90 percent of the foreign currency they receive from businesses to the MMA each week, up from 60 percent previously.

The Maldives is facing heavy external debt repayments — around $500 million this year, rising to MVR 1 billion next year. The World Bank and IMF have warned of possible default risks and urged immediate fiscal reforms, including spending cuts.

The MMA says excess liquidity swelled in recent years after the previous government, under President Ibrahim Mohamed Solih, printed money to cope with the COVID-19 economic downturn — a decision defended by his Maldivian Democratic Party as necessary at the time.